The One Big, Beautiful Bill Act (OBBBA) includes sweeping changes to the U.S. tax code. If you’re an individual taxpayer, you may be wondering what it means for your 2025 tax return. This guide breaks down key provisions, common questions, and proactive steps you can take now.

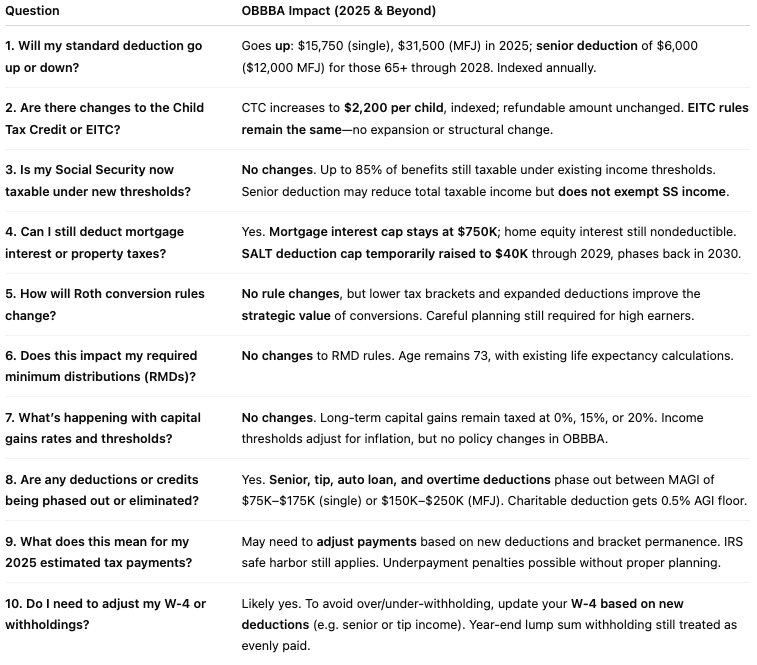

- Will my standard deduction go up or down under OBBBA?

- Are there changes to the child tax credit or earned income tax credit?

- Is my social security now taxable under new thresholds?

- Can I still deduct mortgage interest or property taxes under OBBBA?

- How will Roth conversion rules change?

- Does this impact my Required Minimum Distributions (RMDs)?

- What’s happening with capital gains rates and thresholds?

- Are any deductions or credits being phased out or eliminated?

- What does this mean for my 2025 estimated tax payments?

- Do I need to adjust my W-4 or withholdings based on the new law?

OBBBA Summary Table for Individual Taxpayers

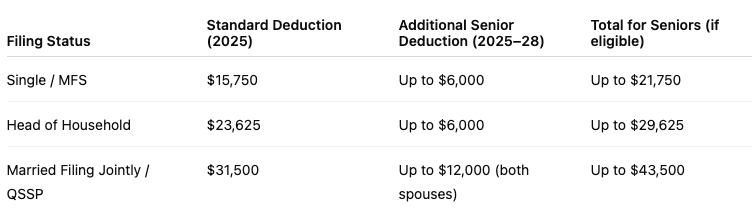

Will my standard deduction go up or down under OBBBA?

The standard deduction will rise starting in 2025 under OBBBA. The tax law permanently fixes the higher TCJA-level standard deduction and increases it for 2025 to:

- $15,750 for Single or MFS filers

- $23,625 for Head of Household

- $31,500 for Married Filing Jointly or Qualifying Surviving Spouse

These amounts will continue adjusting annually for inflation moving forward.

Additionally, taxpayers aged 65 or older can claim a temporary senior deduction of $6,000 per person from 2025 through 2028, phased out beginning at MAGI of $75,000 (single) or $150,000 (joint).

Summary Table

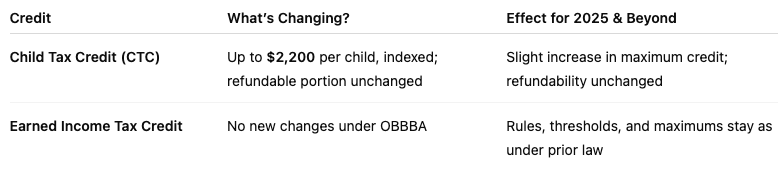

Are there changes to the child tax credit or earned income tax credit?

Child Tax Credit (CTC)

- The maximum CTC increases from $2,000 to $2,200 per qualifying child for tax year 2025 and will be indexed annually for inflation.

- Income phaseout thresholds remain at $200,000 (single) and $400,000 (married filing joint).

- Refundable portion (ACTC) remains the same nominal level, typically dropping around $1,400, but will be inflation-adjusted.

Earned Income Tax Credit (EITC)

- OBBBA does not change any rules for the EITC. Income thresholds, eligibility criteria, and credit amounts remain unchanged. No expansions were included in the final law.

Summary Table

Is my social security now taxable under new thresholds?

No. OBBBA does not change the current rules. Social Security benefits remain partially taxable, up to 85%, based on your income levels, just as under prior law.

- For single, HOH, or QW, up to 85% becomes taxable when combined income exceeds $34,000.

- For married filing jointly, the threshold is $44,000.

What OBBBA does add is a temporary $6,000 senior deduction for taxpayers 65+ (or $12,000 for joint seniors) from 2025 through 2028. While that may reduce taxable income, including Social Security income, it does not eliminate taxation.

Bottom Line

- OBBBA does not change the taxable nature of Social Security benefits, up to 85% of benefits may still be taxed depending on your income bracket.

- Taxpayers aged 65+ can claim a new deduction (through 2028), which helps reduce taxable income, including Social Security income, but does not eliminate taxation.

- Lower-income retirees who already owed no tax on benefits will see minimal benefit; middle-income retirees may see modest relief via the senior deduction, subject to MAGI limitations.

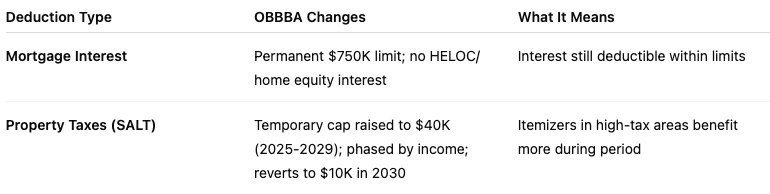

Can I still deduct mortgage interest or property taxes under OBBBA?

Mortgage Interest

- Yes. OBBBA makes permanent the TCJA limit, allowing deductible acquisition debt up to $750,000 for mortgages initiated after December 15, 2017 ($375,000 if MFS). Mortgages above $1M taken before that date are grandfathered.

- No deduction is allowed for home equity loan or HELOC interest, regardless of how the funds were used.

Property Taxes (SALT Deduction)

From 2025 to 2029, OBBBA increases the SALT deduction cap from $10,000 to $40,000 per return (or $20,000 MFS), subject to a phase-out once MAGI exceeds $500,000. The cap gradually returns to $10,000 by 2030.

How will Roth conversion rules change?

OBBBA does not directly modify Roth IRA rules, such as contribution limits, conversion eligibility, or qualified distribution timing. However, it makes the TCJA’s reduced federal income tax rates permanent, indefinitely lowering altitude for Roth conversions in the future.

Additional inflation‑adjusted standard deduction increases (including a senior bonus deduction) further reduce effective tax liability on conversions. Yet, taxpayers must carefully manage Income‑triggered loss of SALT and QBI deductions, Medicare surcharges, and state taxes, which may offset conversion benefits.

Does this impact my Required Minimum Distributions (RMDs)?

No. OBBBA does not change RMD age thresholds or calculation rules. IRA and qualified plan owners must still begin withdrawals at age 73, and the calculation remains based on prior year-end balances divided by IRS life expectancy tables. OBBBA adds no relaxation or extension to RMD deadlines or excise tax provisions.

What’s happening with capital gains rates and thresholds?

Capital gains and qualified dividend tax rates remain unchanged under OBBBA. Long‑term gains continue to be taxed at 0%, 15%, or 20%, with separate higher rates for collectibles or depreciation recapture. The standard TCJA tax brackets remain in effect permanently, but capital gains thresholds are updated for inflation, with no structural change.

Are any deductions or credits being phased out or eliminated?

- Itemized deductions: OBBBA permanently refines prior TCJA suspension of miscellaneous deductions and removes the phase-out (“Pease limitation”) for most filers. However, a new cap on itemized deduction value of 35% applies only to taxpayers in the top (37%) bracket.

- Charitable contributions: A 0.5%‑of‑AGI floor now applies to all charitable deductions.

- Certain deductions like home equity loan interest, personal exemptions, and miscellaneous itemized expenses remain unavailable.

- Meanwhile, OBBBA phases out the new senior, tip, auto‑interest, and overtime deductions between MAGI of $75K–$175K for singles (or $150K–$250K for joint filers).

What does this mean for my 2025 estimated tax payments?

Under OBBBA’s updated deductions and credits, taxpayers should re-evaluate withholding and estimated payments for 2025:

- You must still pay estimated taxes if you owe $1,000 or more and withholding/refundable credits fall below statutory safe-harbors (90% of current-year tax or 100% of last year’s tax) per IRS Pub. 505.

- With higher standard deductions and tax credits for seniors, many lower- and middle-income taxpayers may avoid quarterly payments altogether by adjusting withholding.

- Capital gains or large Roth conversions may require annualizing income or using the Form 2210 method to avoid underpayment penalties when income is uneven across tax periods.

- RMDs with tax withheld, even if taken in December, count as paid evenly throughout the year for estimated payment purposes.

Do I need to adjust my W-4 or withholdings based on the new law?

Yes. Given the new deductions (standard, senior bonus, tip/overtime, auto interest), many taxpayers may find they are over‑or under‑withheld if relying on pre‑OBBBA withholding amounts. It’s prudent to:

- Submit a new Form W‑4 to your employer to increase or decrease withholding.

- For self-employed or investment income earners, consider estimated payments or adjusting withholding on pensions, bonuses, RMDs, or IRA distributions to satisfy safe harbor. You can utilize W-4P or W-4V where applicable.

- Year-end withholding, even in lump sums, is treated as evenly paid over the year for penalty purposes, offering flexibility to fine-tune withholding late in 2025.

Have Questions About How OBBBA Affects You?

The tax changes introduced under the One Big, Beautiful Bill Act are significant, and navigating them effectively can help you avoid surprises, reduce your tax liability, and take full advantage of new opportunities.

Please contact our office to schedule a consultation. We’re here to help you understand how these updates apply to your unique situation and guide you in making confident, tax-smart decisions for 2025 and beyond.