As of July 4, 2025, the “One, Big, Beautiful Bill Act” (OBBBA) was signed into law, reviving the 100 percent bonus depreciation for qualifying property acquired and placed in service after January 19, 2025.

Businesses of all sizes can benefit from immediately expensing eligible capital assets, including both new and used items, eliminating the previous phase‑out schedule and providing long‑term certainty.

Key Highlights for Business Owners

Under OBBBA, here’s what you need to know:

- Permanent reinstatement of 100 percent bonus depreciation for qualifying property acquired and placed in service after January 19, 2025.

- Applies to both new and used property, including machinery, equipment, computer software, furniture, vehicles, and certain improvements to nonresidential real property.

- If a binding written contract was entered into before January 20, 2025, the property does not qualify for 100 percent bonus; instead, the pre‑OBBBA phase‑out schedule applies (i.e., 40 percent in early 2025).

Generally, qualifying property includes:

CCH® AnswerConnect, tangible personal property used in a trade or business or to produce income, with a recovery period of 20 years or less. Examples include:

- Vehicles, furniture, manufacturing equipment, and heavy machinery.

- Depreciable computer software.

- Water utility property.

- Qualified film, television, or live theatrical productions.

- Qualified improvement property, which refers to interior improvements to commercial buildings.

- Acquisition and Placed-in-Service Dates: For property placed in service after January 19, 2025; to qualify for the full 100% bonus depreciation, it must also have been acquired after January 19, 2025. The acquisition date is considered no later than the date a binding contract for acquisition is executed.

Key eligibility factors are also important, such as:

- Placed in Service Date: The property must be placed in service during the current tax year to qualify for bonus depreciation in that year.

- Useful Life: The property must have a useful life of 20 years or less to be eligible.

- Original Use: In some cases, the original use of the property must begin with the taxpayer. However, used property acquired after September 27, 2017, may also qualify.

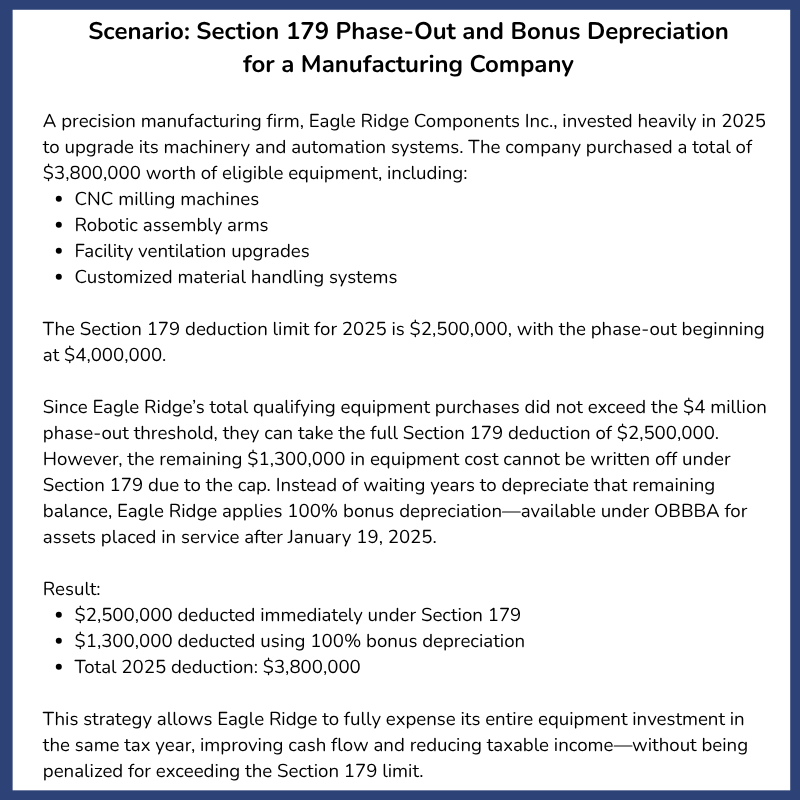

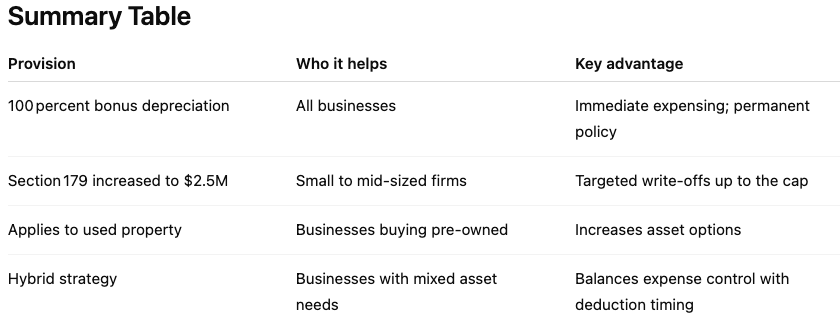

How Section 179 and Bonus Depreciation Work Together

Alongside bonus depreciation, OBBBA also raises the Section 179 expensing limit to $2.5 million in 2025, and $4 million in 2026. This creates powerful planning flexibility:

- Use bonus depreciation for large‑scale or used equipment purchases.

- Use Section 179 for targeted expensing of smaller or strategic assets.

Together, these provisions allow clients to front‑load deductions, manage taxable income effectively, and preserve operating cash flow.

Strategic Opportunities for Your Business

- Accelerate cash flow relief. Immediate expensing via bonus depreciation can significantly reduce taxable income in the year of acquisition.

- Tailor tax strategy. Section 179 gives more precision when expensing cap‑cost assets; bonus depreciation handles the rest.

- Timing decisions matter. Only property acquired after January 19, 2025, qualifies for full bonus depreciation—contracts entered before that date may limit the deduction.

- Document carefully. Keep detailed records of contract dates, acquisition dates, and placed‑in‑service dates to support bonus depreciation eligibility.

Benefits Behind the Numbers

This permanent reinstatement offers:

- Cash flow improvement through large immediate deductions instead of multiyear depreciation.

- Tax predictability—no future step‑down in bonus depreciation.

- Broader access to expensing for both new and used qualifying property.

- Greater planning flexibility combining Section 179 and bonus depreciation to match client needs.

Act Now

If you plan to invest in machinery, equipment, vehicles, software, or building improvements:

- Review pending capital expenditures and ensure acquisitions occurred after January 19, 2025, to qualify.

- Evaluate whether Section 179 or bonus depreciation offers the better outcome based on cash flow and taxable income planning.

- Document binding contracts and placed‑in‑service dates to support a full deduction.

- Coordinate with multi‑state operations to confirm that state conformity does not limit federal deductions.

This is an ideal time to revisit capital investment plans. The return of bonus depreciation paired with enhanced Section 179 limits offers a significant planning window—especially for businesses undertaking capital expansions in 2025 and beyond.

Ready to optimize capital investment and minimize tax liability?

Contact us today to schedule a planning session and ensure your investments take full advantage of the new permanent bonus depreciation regime.