For years, the Qualified Business Income (QBI) deduction has been one of the most valuable tax breaks available to small business owners and pass-through entities.

Originally set to expire in 2025, the deduction is now a permanent part of the tax code. This change not only secures long-term tax savings but also provides business owners with greater clarity when planning.

What Is the QBI Deduction?

The QBI deduction, also known as the Section 199A deduction, allows eligible taxpayers to deduct up to 20% of qualified business income from pass-through entities such as:

- Sole proprietorships,

- Partnerships,

- S corporations, or

- Certain trusts and estates.

It can also include up to 20% of qualified REIT dividends and publicly traded partnership (PTP) income. However, the deduction does not apply to income earned through a C corporation, and it is subject to limits based on taxable income, wages paid, and the type of business.

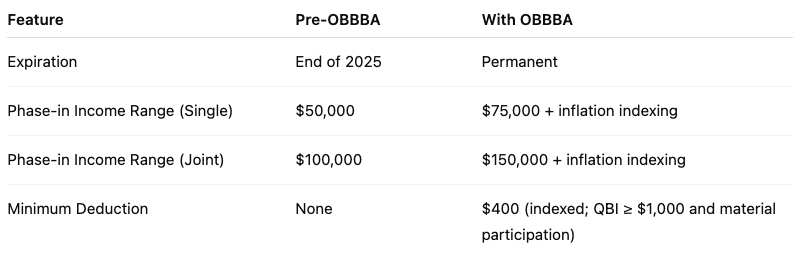

What Changed Under the New Law?

The One Big Beautiful Bill Act (OBBBA) made significant updates to the QBI deduction, such as:

- Permanent Extension: No more sunset date.

- Expanded Income Thresholds:

- For single filers, the phase-in range increased from $50,000 to $75,000.

- For married couples filing jointly, the range increased from $100,000 to $150,000.

- Both are now indexed annually for inflation.

- Minimum Deduction Added: Active business owners who materially participate and have at least $1,000 in QBI can receive a minimum deduction of $400, adjusted for inflation.

- Specified Service Trade or Business (SSTB) Relief: Professions like accounting, consulting, health, and law remain subject to phase-outs, but the broader thresholds mean more owners may now qualify for a full or partial deduction.

Key Changes Summary

Why This Matters for Your Business

With these changes, business owners gain several advantages, such as:

- Certainty for long-term tax planning.

- More opportunities to qualify with expanded income thresholds, reducing limitations for many owners.

- The small business benefit of a $400 minimum deduction ensures that even modest earners see a tangible tax break.

- SSTB flexibility may now make more service-based businesses eligible for at least part of the deduction.

Next Steps for Business Owners

To make the most of the QBI deduction:

- Review your business structure and taxable income to confirm eligibility.

- Evaluate whether you fall into the expanded phase-in ranges.

- Factor the deduction into long-term financial and succession planning.

- Consult your tax advisor to optimize W-2 wage strategies, depreciation planning, and retirement contributions that may impact the deduction.

The QBI deduction is now a permanent tax savings opportunity for business owners. With expanded thresholds, a guaranteed minimum deduction, and stability beyond 2025, more entrepreneurs can take advantage of this powerful benefit.

Our team is here to help you understand how these changes apply to your situation and to guide you in maximizing the deduction. Contact us today to discuss your options.