Getting organized early keeps tax season calm and predictable. Waiting until February or March often leads to missing forms, last-minute scrambling, and preventable delays. Starting now gives you time to track down documents, correct errors, and spot planning opportunities before deadlines get tight.

Why Early Prep Makes Filing Easier

Documents arrive from many places, and they don’t always arrive at the same time. When you have your checklist ready, it’s much simpler to stay on top of what’s missing and keep everything in one place. Early organization also helps catch issues long before they slow down your return.

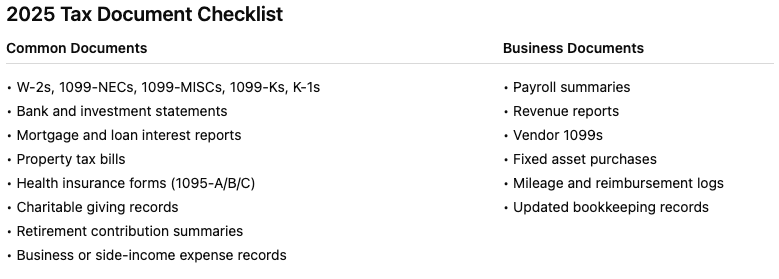

Download the “2025 Tax Document Prep List.”

What to Gather This Year

Use this as a master list and check items off as they come in.

FAQs: Tax Documents

When should I start?

Now. Early review means more time to fix mistakes and request corrected forms.

When do forms arrive?

Most come in mid-January through early February. K-1s may arrive later.

What do people forget?

Brokerage statements, corrected 1099s, HSA/FSA summaries, and paperwork related to moves, home purchases, or major life changes.

Do I need every receipt?

Not if the transaction is already in your bookkeeping system or bank statements. Keep backup for large, unusual, or audit-sensitive items.

What if a form is wrong?

Request a corrected version right away. Fixes can take weeks.

Life Events That Change Your Tax Filing

Marriage, divorce, a new child, buying or selling a home, moving to a new state, or starting a business all create new documents and reporting requirements. Flag these changes early to avoid surprises at filing time.

Avoid the Most Common Filing Mistakes

Checking forms as they arrive helps you catch incorrect numbers, missing basis info, late statements, and documents that come in batches. Waiting until everything is in hand often leads to oversights.

Need a Hand Getting Organized?

We can review your documents, highlight gaps, and help you prepare a clean, tax-ready file.

Download the 2025 Tax Document Prep List and contact us when you’re ready for support.